Pension Plan Reform Ontario Canada

Pension plan reform is being introduced by both the Ontario Government and the Federal Government this year.

- Ontario Introduces New Mandatory Pension Plan – New Law

- Ontario Introduces Voluntary Retirement Savings Tool – New Law is awaiting Royal Assent

- Federal Government Proposes Expansion of Canada Pension Plan (CPP)

Ontario Introduces New Mandatory Pension Plan

At the end of April the Ontario Government introduced the budget and reinforced their commitment to establish a new, mandatory Ontario Pension Plan. Bill 56, the Ontario Retirement Pension Plan Act (ORPP) received royal assent on May 5, 2015.

The new law will come into force on January 1, 2017. The new Pension Plan will require Ontario employers and employees to make equal contributions up to 1.9% of an employee’s annual earnings up to $90,000.

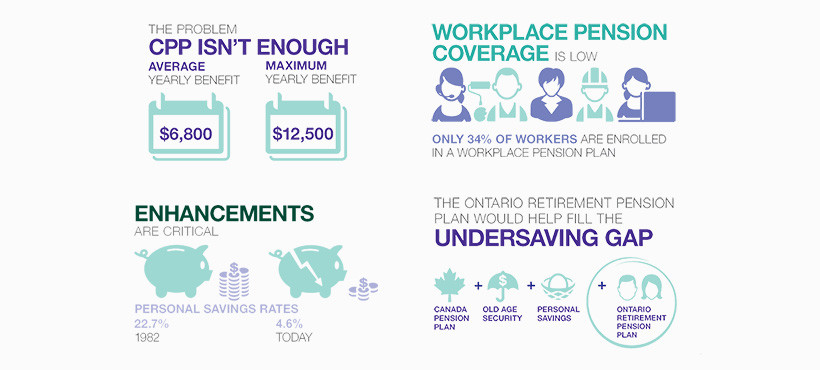

As outlined in the preamble to Bill 56, a significant portion of Ontario workers are not saving enough to maintain their standard of living when they retire. The new pension plan is expected to cover about half of Ontario’s six million workers – excluding those workers who already participate in a pension plan and self employed workers. The provincial plan is the first of its kind in Canada and will top up benefits already in place under the Canada Pension Plan.

The ORPP has been criticized as just another payroll tax for employers. The Government has attempted to minimize the impact for employers by pairing the introduction of the plan in 2017 to coincide with the expected reductions in Employment Insurance premiums. The plan will be phased in over 2 years beginning with large employers.

Read more about Ontario’s new pension plan.

Ontario Introduces New Pooled Registered Pension Plans

On May 26, Bill 57, the Pooled Registered Pension Plans Act (PRPP) passed 3rd reading and is awaiting royal assent. The Ontario PRPP is modeled after the Federal Government plan introduced in 2012. The PRPP is a new voluntary retirement savings tool. The plan is designed to operate like a defined contribution pension plan where resources are pooled from employees and employers.

Federal Government Proposes Expansion of CPP

On May 26 the Federal Government announced they will undertake public consultations on the expansion of the Canada Pension Plan (CPP). The proposed changes would allow Canadians to voluntarily increase contributions to CPP.